- Home

- Company Info

- Medium-Term Management Plan 2026

Medium-Term Management Plan 2026

The Group launched the Nisshin Seifun Group Medium-Term Management Plan 2026 in fiscal 2023. The new five-year plan to fiscal 2027 was formulated to reflect anticipated near- and medium-term changes in the business environment. During the Medium-Term Management Plan period, we achieved significant growth and were likely to meet the initial targets for the final year of the period. Accordingly, in fiscal 2025, we revised the targets upward. Following our guiding philosophies and corporate principle, we will fulfill our mission to provide a stable supply of wheat flour and other foods and contribute to society through our business as we continue to grow as a core corporate group in the food industry.

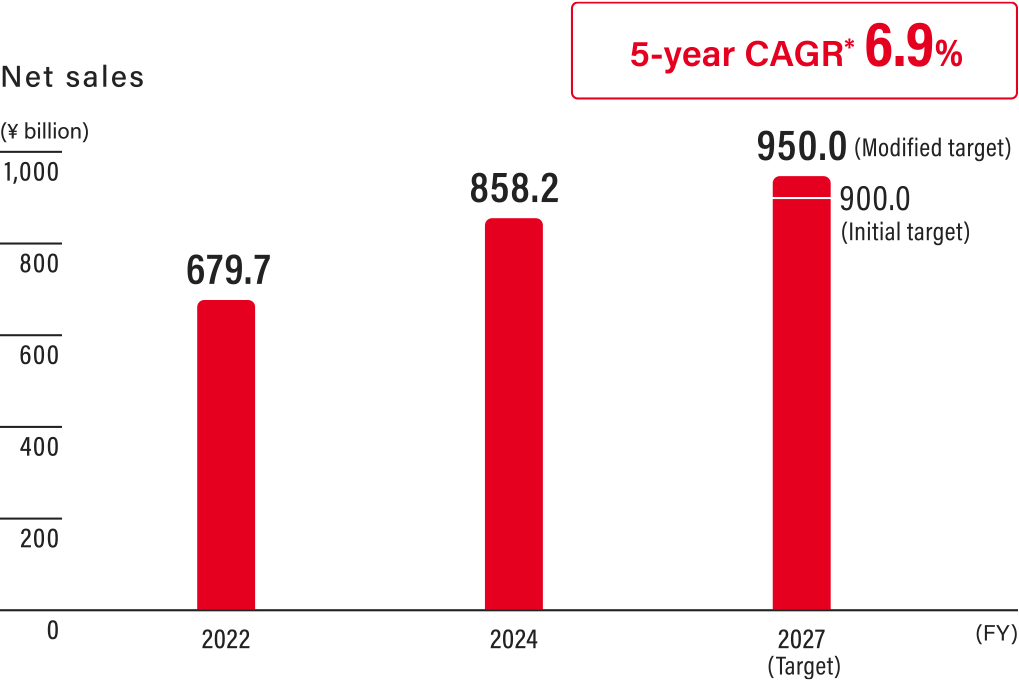

Quantitative Targets

We are actively engaging in strategic investment as we restructure our business portfolio through selection and concentration. The medium-term plan sets targets of 950 billion yen in net sales and 57 billion yen in operating profit in its final year of fiscal 2027.

* Compound Annual Growth Rate

Basic Policy

The Group is advancing the three following Basic Policies of the Medium-term Management Plan 2026 toward realizing our Group vision.

Basic Policy 1: Stimulate the Group’s ability to grow by restructuring the business portfolio

The strengths of our Group are the high-level technological capabilities and productivity we have accumulated over our 120-year history and our solid sales foundation built on the strong relations of trust with our customers. We will continue restructuring our business portfolio in areas we can take advantage of these strengths to boost our competitiveness in each business area and for the Group overall.

(1) Strategy to enhance business competitiveness

1. Continuation and expansion of the domestic flour milling, processed food, and yeast businesses as core businesses

We will use strengths cultivated in each of our businesses, provide new value to expand our market share, and maintain appropriate pricing for our products. We will also lower costs in various areas to maintain our high profit levels and ensure the domestic flour milling, processed food, and yeast businesses continue to be the Group’s core businesses.

Key topics

- Creation of synergies with Kumamoto Flour Milling

- Preparation of a low-cost production system (cost competitiveness, automation, labor saving)

- Cultivation and spread of the Nisshin Seifun Welna brand

2. Growth strategy for overseas business (“made and sold locally” model)

In our medium-term management plan, we aim to develop our overseas business into a growth driver for the group. New investment overseas will be conducted after verifying the viability of applying our strengths in Japan to the overseas market.

Key topics

- Overseas flour milling business

• Improvement of performance in the Australia flour milling business

• Advancement of initiatives to maintain and strengthen high profitability of the U.S. flour milling business and other businesses - Overseas processed food business

• Consideration of future investments (premixes, pasta, pasta sauces, frozen foods)

• Promotion of local sales of processed foods produced at overseas production sites or shipment to Japan - India yeast business

• Achievement of profit growth through smooth launching and reaching full production capacity

3. Growth strategies for prepared dishes and other prepared foods business

The prepared food market is one of the few growing markets in the domestic food industry. We established Nisshin Seifun Delica Frontier Inc. to lead our efforts in this market and ensure cost competitiveness to enable us to win against rival firms. We plan to develop synergies with the flour milling and processed food businesses to generate business growth.

Key topics

- Strengthening R&D capabilities (chilled and frozen prepared foods, extension of expiration dates, etc.)

- Promotion of labor saving through automation

- Collaboration with the flour milling and processed foods businesses to fully leverage our development potential

4. Business direction of healthcare foods and biotechnology businesses

We aim to create synergies in research and development and new businesses in our healthcare foods and biotechnology businesses, and to achieve growth in both businesses.

5. Business direction of the engineering and mesh cloth businesses

Both businesses have world-class technical capabilities and knowledge and are looking to expand their business ranges either organically or through external collaborations. They will also look to combine their technologies to pursue business collaborations in the electronic components and other markets. The mesh cloth business will leverage its technological superiority to increase its profits by applying its products to applications related to the environment and creating a sustainable society.

6. Taking on the challenge of new businesses

Please see (3) New business development and M&A strategy.

(2) R&D strategy

Secure competitive advantages in Japan and overseas to drive the Group’s growth and generate cyclical growth by using our businesses to address social issues and enhancing corporate value.

Research topics in focused R&D areas

| Food ingredients with health functions | Promote R&D on various health functionalities, centering on wheat ingredients, including effects on preventing metabolic syndrome, brain function, and anti-aging, and use our business to extend healthy life expectancy. |

|---|---|

| Processing technology for prepared dishes and other prepared foods | Strengthen competitiveness by promoting R&D on cooking and processing technologies that improve the taste, aroma, color, texture, and other qualities of prepared foods, and R&D on microorganism control technologies that lead to longer expiration dates (waste reduction, including in the supply chain). |

| Food tech | Develop new businesses and secure competitive advantage in existing businesses by engaging in R&D on technologies to solve food-related problems, such as the protein crisis and food loss, with an eye to collaborating with startup companies. |

| Automation | Realize additional labor and energy savings in the prepared dishes and other prepared foods business, the flour milling business, and other businesses by leveraging digital technology (AI, IOT) and robotics technology. |

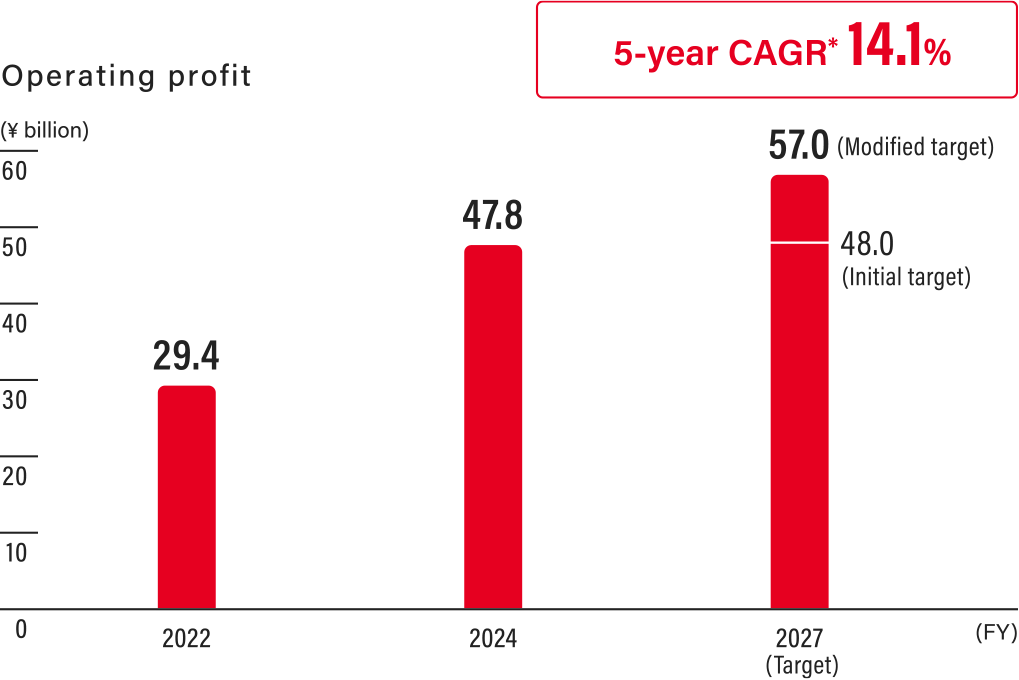

(3) New business development and M&A strategy

Secure competitive advantage in existing businesses, acquire and nurture businesses that will become the future core businesses succeeding our flour milling, processed foods, yeast, and prepared dishes and other prepared foods operations. Promote new business development through M&A and collaboration with start-ups, anticipating innovation in new areas, such as food tech and functional ingredients.

Target areas for existing and new businesses

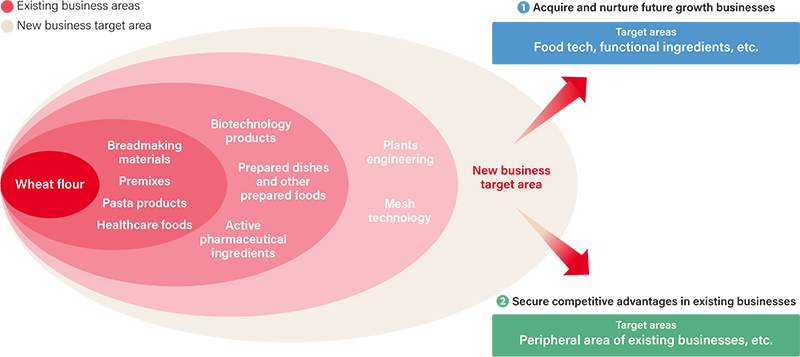

(4) Digital strategy

Actively incorporate digital technology to dramatically improve productivity, revise the business models of existing businesses, create new business models, and enhance our competitiveness. In addition, continuously verify and review our system structure to strengthen resilience against cyber-attacks, and continue securing and training digital technology human resources.

Basic Policy 2: Enhance management by clarifying our business’ relationships toward our stakeholders

We recognize that the Group’s fundamental purpose is to provide a stable supply of staple foods centered on our wheat flour and other wheat products, and therefore seek to be a company that fulfills the expectations of all stakeholders and is trusted around the world.

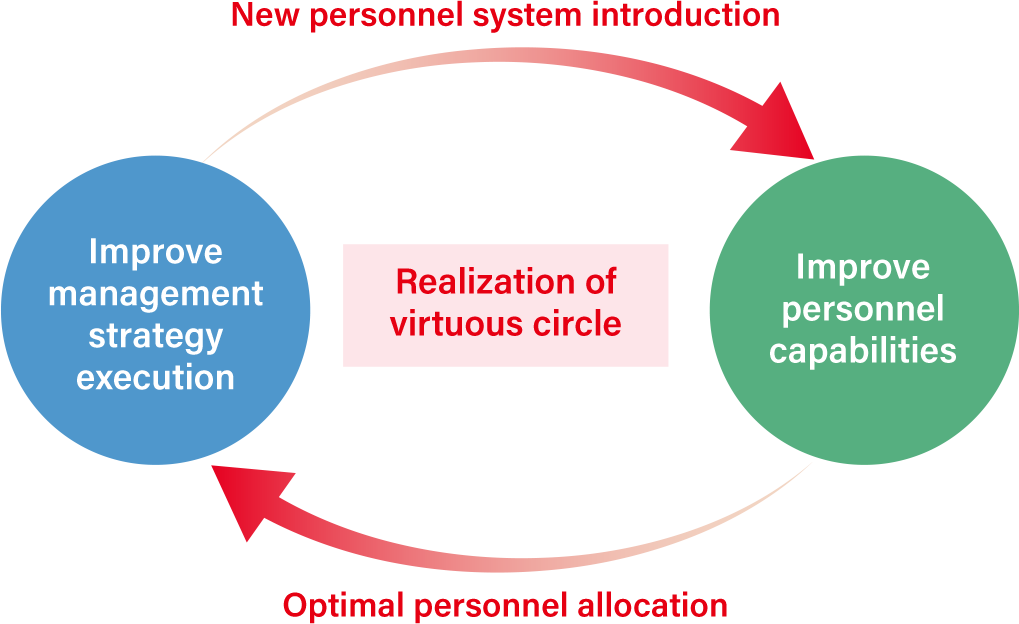

The Group holding company Nisshin Seifun Group Inc. and all Group companies will work as one to continue earning the trust of customers and business partners. We are also advancing the HR strategy to revitalize the organization and human resources by optimizing HR allocation throughout the Group, developing management personnel, promoting the active participation of women, and instituting work style reforms.

Shareholders: Enhance our long-term corporate value to provide appropriate total shareholder return

Customers: Offer value exceeding customer expectations in all aspects of products and services

Employees: Provide appropriate compensation and working environments and support skills acquisition

Business Partners: Engage with business partners fairly, impartially, and with a sense of ethics as equal partners

Society: Work with society and be an eco-friendly company

Human Resource Strategy

Key topics of the human resources strategy

- Strengthen recruitment

- Promote diversity

- Promote women’s participation and career advancement

- Improve the working environment

- Promotion of work style reforms ➝ Measures to improve psychological safety

- Use of the Engagement Survey

- Health Management Promotion ➝ Certified Health & Productivity Management Outstanding Organization (White 500)

- Strengthen skill development

- Management personnel training ➝ Implementing a proprietary “Business Manager Development Program”

- Develop digital human resources

- Develop global human resources, etc.

Basic Policy 3: Integrate ESG into management strategy, implement by adapting to social trends

Society expects companies to keep pace with social trends and proactively address ESG issues while simultaneously seeking to maximize corporate value. We consider it the responsibility of both the holding company, Nisshin Seifun Group Inc., and each of the Group companies to pursue both of these objectives. Among the ESG issues, we have made addressing environmental issues a management priority for its vital role in global sustainability.

We are maximizing the use of energy-saving equipment and renewable energy to achieve medium- and long-term targets for environmental issues related to climate change, and also considering energy procurement from off-site facilities.

Environment

We have set medium-to-long-term goals of reducing CO2 emissions from Group-owned facilities by 50% compared to the fiscal 2014 level by 2030 and achieving net zero CO2 emissions by 2050. To achieve this, we are installing equipment with maximum energy efficiency and facilities that generate renewable energy, while also considering green energy procurement from off-site facilities.

Society

Our social mission is to provide a stable supply of safe and reliable products. We are clarifying our approach to stakeholders and asking ourselves if we could clearly explain the work we are doing to the consumer in all aspects of our business, including quality assurance. We will also carry out exhaustive human rights due diligence throughout our operations and supply chain to identify any issues and reduce risk.

Governance

The Group maintains a corporate culture of constantly reviewing the status of our governance and implementing any changes needed for improvement. We also continuously review risks, apply and fortify our internal control systems, and maintain constant preparedness for countermeasures. Understanding that it is impossible to eliminate all potential risks, in the event of an emergency, the President of Nisshin Seifun Group Inc. and presidents of the operating companies will take the lead and make every effort to avoid a worst-case scenario.

Capital Policy

Group management maintains control of the capital structure with an appropriate balance of financial stability and steps to improve capital efficiency while giving full consideration to our social responsibility to provide a stable supply of flour and other food staples.

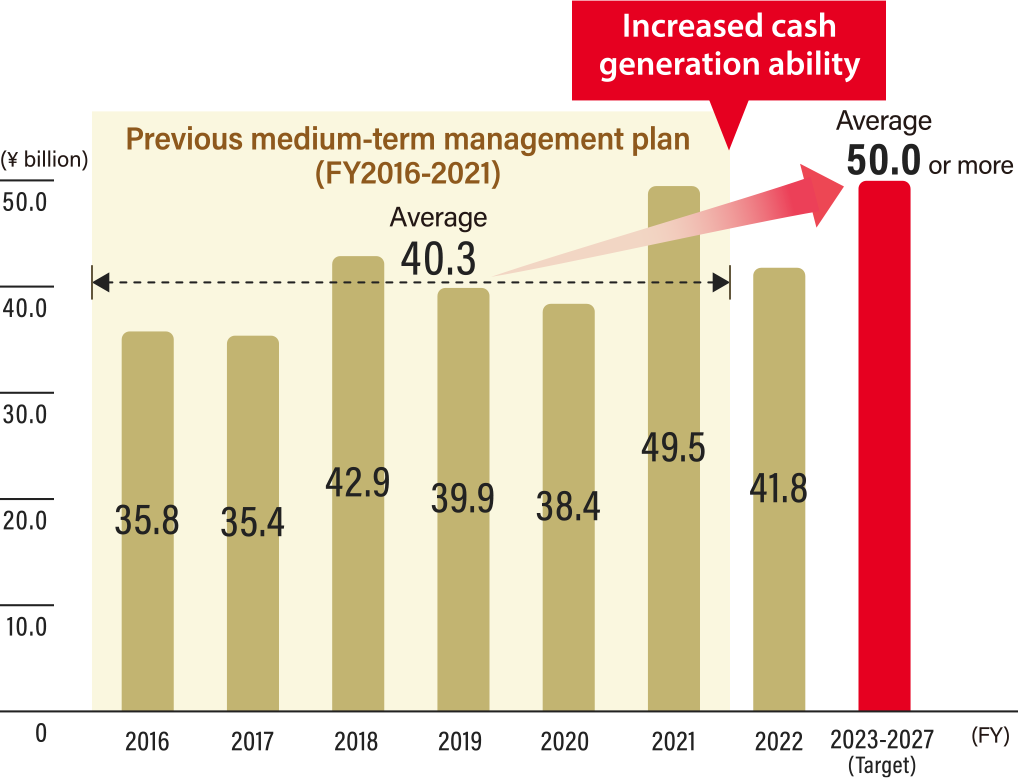

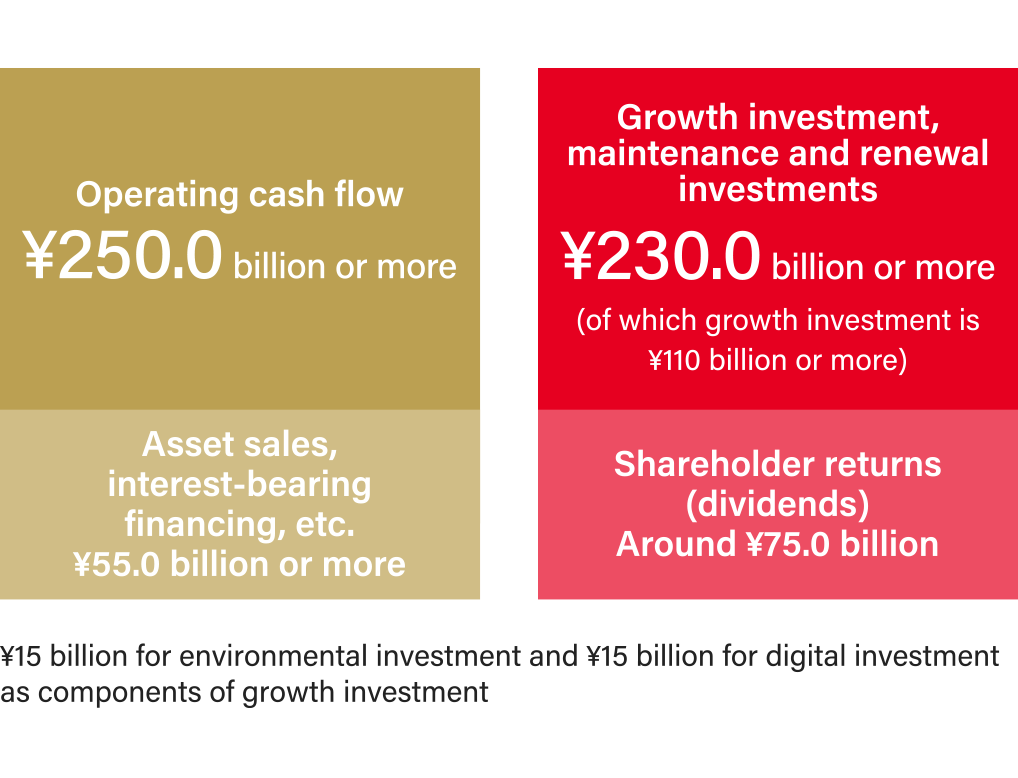

We will use available funds and operating cash flow generated during the five years of the Medium-Term Management Plan for aggressive long-term investment and to continue increasing earnings per share (EPS).

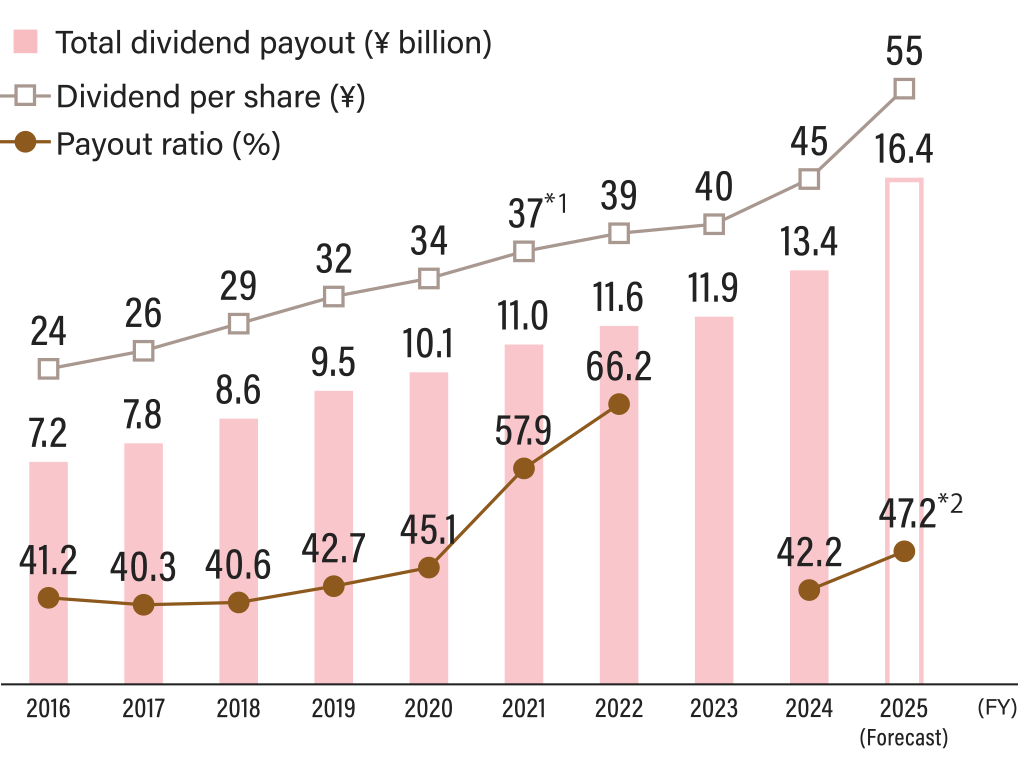

We aim to increase the consolidated payout ratio to around 50% by the final year of the current Medium-Term Management Plan. The payout ratio is calculated by excluding non-recurring profits or losses from profit attributable to owners of parent.

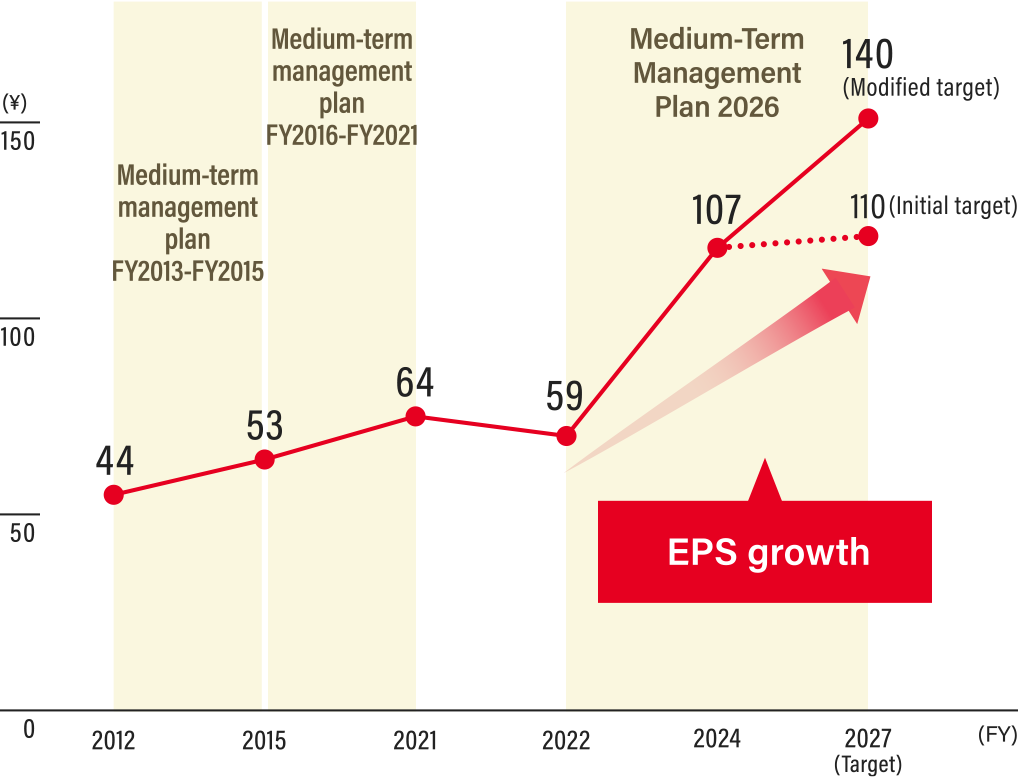

(1) EPS growth and appropriate total shareholder return

We seek to increase our earnings per share by strengthening our earnings and sales capabilities and strategically investing (including capital investment, M&A, R&D, digital technologies, and human resources development) to restructure our business portfolio through selection and concentration. Our objective is to maintain a stock price that earns the trust of shareholders and provides an appropriate level of total shareholder return.

Group operating cash flow and targets

Five-year cumulative cash-flow plan

(2) Strengthening shareholder returns

We aim to increase the consolidated payout ratio to around 50% by the final year of the current Medium-Term Management Plan. The payout ratio is calculated by excluding non-recurring profits or losses from profit attributable to owners of parent. At the same time, our objective is to increase earnings per share, and we will proactively consider raising the dividend amount at an appropriate time.

EPS and targets

Total dividend and dividend payout ratio

- *1 Fiscal 2021 included a ¥2 dividend per share to commemorate the 120th anniversary of the Company’s founding.

- *2 The payout ratio for fiscal year 2025 (Forecast) is calculated excluding non-recurring profits or losses.

(3) Ensuring financial stability based on our social responsibility

Considering the social nature of our Group’s businesses, we strive to maintain a stable financial foundation to ensure business continuity in the event of a severe disaster. We will review and steadily reduce our strategically held shares while taking into account the structure of our business relationships, such as strengthening business alliances and joint ventures. As we restructure our business portfolio, we are aiming to improve capital efficiency and effectively manage invested capital to ensure our financial stability.